When it comes to crypto, South Korea isn’t just another market on the map; it’s a powerhouse that consistently punches above its weight. From buzzing trading floors on Seoul’s exchanges to government-led experiments with digital currency, the South Korean crypto scene is fast-moving, innovative, and sometimes a little unpredictable. For global investors and businesses, understanding this ecosystem isn’t optional; it’s essential. If you’re eyeing new investment opportunities, seeking regulatory clarity, or simply trying to decode why South Korea ranks among the most active crypto hubs in the world, this deep dive will give you the insights you need (without the jargon overload).

Table of Contents

Overview of the South Korea Crypto Landscape

If there’s one country that treats crypto trading with the same enthusiasm as a national sport, it’s South Korea. The South Korea Crypto market has become one of the most dynamic and influential in the world, thanks to a perfect storm of tech-savvy citizens, strong digital infrastructure, and a culture that embraces innovation (and yes, a bit of risk-taking).

South Korea’s love affair with digital assets goes back nearly a decade, when Bitcoin first caught the public’s attention and quickly became more than just a speculative trend. Today, the country consistently ranks among the top global markets in terms of trading volume and adoption rates. On any given day, trading activity on Korean exchanges like Upbit and Bithumb rivals or even surpasses that of some Western giants.

But it’s not just about the numbers, it’s about who’s participating. Unlike in many markets where institutional investors dominate, South Korea’s crypto scene thrives on retail traders. Everyday citizens, from students to professionals, actively trade digital assets, often with the same intensity they bring to stock markets or e-sports. This high level of retail involvement has made South Korea a fascinating case study for global investors looking to understand how cultural factors drive adoption.

What makes the South Korea crypto landscape especially compelling is its blend of innovation and regulation. On the one hand, the country has given birth to crypto-friendly startups, blockchain gaming projects, and an early appetite for NFTs and metaverse platforms. On the other hand, regulators have introduced strict compliance measures, ranging from real-name account verification to anti-money laundering laws, to protect investors and stabilize the market.

In short, South Korea has established a vibrant, highly engaged, and globally significant crypto ecosystem. For investors and businesses, keeping an eye on this landscape is less about curiosity and more about strategy, because what happens in South Korea’s crypto markets often sends ripples across the rest of the world.

South Korea Crypto Regulations and Legal Framework

South Korea’s crypto market didn’t just grow wild; it was carefully pruned, shaped, and occasionally clipped by regulators. If the South Korean crypto scene looks as vibrant as it does today, that’s partly thanks to a government that keeps a very close eye on digital assets. For global investors and businesses, understanding this legal landscape isn’t just useful, it’s absolutely critical.

The Role of Regulators

At the heart of South Korea’s crypto oversight is the Financial Services Commission (FSC), the country’s top financial watchdog. Alongside the Financial Supervisory Service (FSS), these regulators ensure that crypto trading doesn’t become the digital equivalent of the Wild West. Their primary goals? Investor protection, market stability, and ensuring that money laundering doesn’t slip under the radar.

Key Regulatory Milestones

South Korea has rolled out several pivotal laws over the years:

- 2018–2019: Real-name bank accounts became mandatory for crypto traders, marking the end of anonymous, free-for-all days.

- 2020: The Special Financial Transactions Information Act was revised, introducing strict anti-money-laundering (AML) measures.

- 2021–2022: Only exchanges registered with the FSC (and partnered with approved banks) were allowed to operate, drastically reducing the number of active platforms.

These measures didn’t just reduce the number of exchanges; they also enhanced trust, making South Korea’s market one of the more transparent ones globally.

Crypto Taxation Policies

The government has been working on crypto taxation laws for years, with proposals to tax profits above a certain threshold. While the start date for enforcement has shifted more than once, the intent is clear: crypto in South Korea is no longer an “untaxed loophole” but a legitimate financial activity subject to oversight.

Impact on Investors and Businesses

For investors, these rules mean greater safety, but also less flexibility. For businesses, compliance is no longer optional; it’s the price of entry. Foreign exchanges looking to tap into Korean demand must align with strict licensing and reporting standards, often requiring local partnerships to gain entry.

In short, South Korea crypto regulations might feel tight, but they also create a structured environment that global players can trust. For anyone considering entry into this market, the mantra is simple: compliance first, opportunity second.

Crypto Trading in South Korea

If crypto were a sport, South Korea would be fielding a championship team. The country is home to one of the most active trading environments in the world, with volumes that often rival or even surpass those of larger economies. For anyone watching the South Korea Crypto scene, trading is where the action really happens.

Top Exchanges Driving the Market

The backbone of crypto trading in South Korea lies in its powerful homegrown exchanges:

- Upbit – The undisputed leader, often commanding the lion’s share of daily trading volume.

- Bithumb – Once a market giant, it remains a strong contender with a diverse range of listings.

- Coinone and Korbit – Smaller in comparison, but key players in offering variety and competition.

These platforms don’t just move coins; they shape investor behavior, influence liquidity, and even impact global market sentiment when trading spikes.

Retail Traders vs. Institutions

Unlike some regions where large institutions dominate, South Korea’s trading scene has been mainly retail-driven. Every day, people, students, young professionals, and even retirees actively participate in day trading. For many, crypto isn’t just an investment; it’s part of daily financial life. That said, institutional interest is growing, with hedge funds and financial firms cautiously dipping their toes in, especially as regulations tighten and the market stabilizes.

Unique Market Behaviors

South Korea has a reputation for “crypto fever,” with frenzied buying sprees that have occasionally created the famous “Kimchi Premium”, a phenomenon where Bitcoin and other coins trade at higher prices in Korea than in global markets. While the premium isn’t as extreme as it once was, it still highlights the intensity of local demand and the willingness of Korean investors to pay for access.

Challenges for Global Players

For foreign investors and businesses, entering South Korea’s trading ecosystem isn’t as simple as opening an account. Regulatory requirements demand that exchanges partner with local banks and implement real-name verification systems. These strict measures, while excellent for preventing fraud, create significant barriers to entry for international companies hoping to serve Korean traders.

Quick Snapshot: Crypto Trading in South Korea

- Top Exchanges: Upbit, Bithumb, Coinone, Korbit

- Market Drivers: Retail investors dominate, with growing institutional interest

- Unique Factor: “Kimchi Premium” – local prices often higher than global averages

- Trading Volume: Among the highest globally, sometimes rivaling U.S. and European exchanges

- Regulatory Hurdle: Real-name bank accounts and strict compliance are required for all traders

- Global Impact: Sudden surges in Korean trading can influence global crypto sentiment

Investment Opportunities in South Korea’s Crypto Market

When it comes to spotting growth in the digital asset world, South Korea isn’t just keeping up; it’s setting the pace. The South Korea Crypto market offers fertile ground for global investors and businesses who know how to navigate its unique blend of innovation and regulation. From blockchain-powered gaming to venture-backed startups, the opportunities here go well beyond the occasional Bitcoin trade.

DeFi and Blockchain Innovation

South Korea has quietly become a hub for decentralized finance (DeFi). Startups are experimenting with new lending, staking, and trading platforms, while traditional financial institutions closely monitor blockchain integrations. For investors, this means access to a rapidly evolving ecosystem where real-world applications of DeFi are gaining momentum.

NFTs and Gaming

If there’s one place where gaming meets crypto, it’s South Korea. The country’s global dominance in the gaming industry has naturally spilled into blockchain-based games and NFTs. Companies are developing play-to-earn models and metaverse projects, attracting not just local players but global attention. For businesses, this sector is ripe with opportunities to invest, partner, or innovate.

Crypto Startups and Venture Capital

The startup scene in South Korea is buzzing with blockchain and crypto-related ventures. From digital asset custody solutions to Web3 platforms, entrepreneurs are pushing boundaries. Venture capital firms, both local and international, are already funding these projects, making them an ideal entry point for investors seeking early-stage opportunities.

Institutional Adoption

While retail traders may dominate the headlines, institutions are gradually entering the market. Asset managers and fintech companies are exploring crypto investment products, signaling a gradual but meaningful shift toward mainstream acceptance. This opens doors for international firms to collaborate on products that bridge traditional finance with digital assets.

Global Partnerships and Market Entry

South Korea’s strong digital infrastructure and high internet penetration make it an attractive launchpad for international crypto firms. It can be exchanges seeking local partnerships or blockchain projects looking to expand their reach; the Korean market offers a tech-savvy and highly engaged audience.

In short, investment opportunities in South Korea’s cryptocurrency market span DeFi, NFTs, startups, and institutional finance. The key isn’t just spotting the trends; it’s aligning with the local culture and regulatory framework to ensure long-term growth.

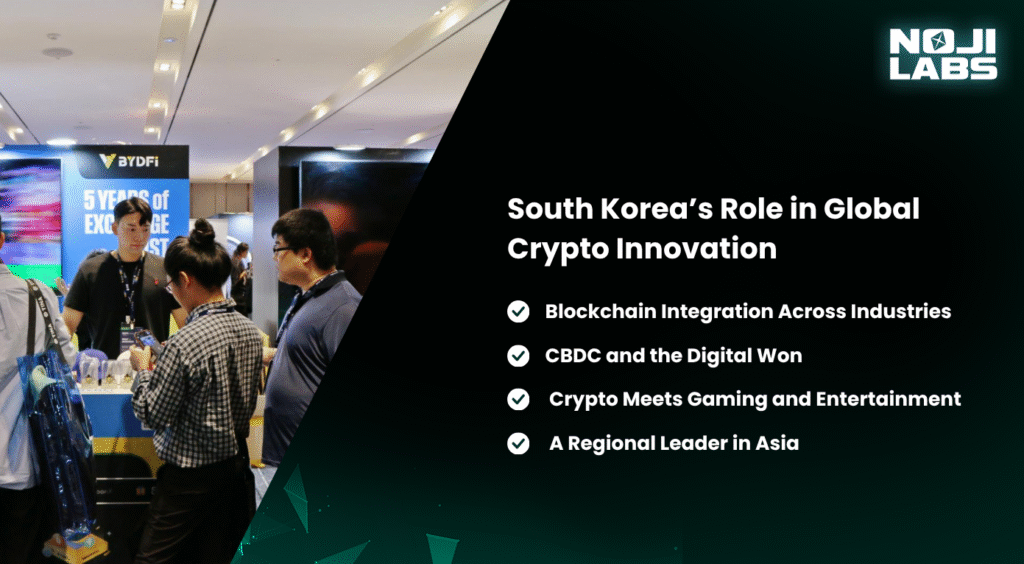

South Korea’s Role in Global Crypto Innovation

South Korea may be geographically small, but in the world of crypto innovation, it punches far above its weight. The country’s combination of a hyper-connected society, strong government interest in digital transformation, and a fearless startup culture makes it one of the most influential hubs in the global blockchain economy. For anyone eyeing the South Korea Crypto market, this isn’t just a local story; it’s a global one.

Blockchain Integration Across Industries

South Korea isn’t limiting blockchain to trading floors. Banks, telecom companies, logistics firms, and even the healthcare sector are actively exploring blockchain for security, transparency, and efficiency. These cross-industry applications position South Korea as a testbed for real-world use cases that other countries often watch and later replicate.

CBDC and the Digital Won

The Bank of Korea has been at the forefront of central bank digital currency (CBDC) research, with pilot programs exploring the “digital won.” While still in development, this initiative shows South Korea’s intent to stay ahead of the curve in redefining money itself. If successful, the digital won could influence how other nations approach CBDCs, giving South Korea a leadership role in shaping the future of state-backed digital assets.

Crypto Meets Gaming and Entertainment

South Korea’s cultural exports, think K-pop and online gaming, are already global phenomena. Now, these industries are embracing crypto through NFTs, tokenized fan experiences, and metaverse projects. The result? South Korea is exporting not only music and games but also new models of how blockchain can drive global entertainment economies.

A Regional Leader in Asia

When it comes to crypto innovation, South Korea is often mentioned alongside Singapore, Japan, and Hong Kong. But unlike its neighbors, South Korea stands out for its retail-driven adoption and cultural integration of digital assets. This unique flavor of innovation makes it a key reference point for both policymakers and investors worldwide.

Put simply, South Korea isn’t just participating in the global crypto movement; it’s shaping it. From blockchain in finance to the rise of a digital won, the South Korea crypto ecosystem continues to set examples that ripple far beyond its borders. For global businesses and investors, keeping tabs on Korea isn’t optional; it’s strategic.

Risks and Challenges in the South Korean Crypto Market

For all its energy and opportunity, the South Korea Crypto market isn’t exactly a smooth ride. Like any high-growth sector, it comes with its fair share of speed bumps and sometimes full-on roadblocks. From regulatory shifts to market volatility, global investors and businesses need to look beyond the hype and prepare for the hurdles.

Regulatory Uncertainty

If there’s one constant in South Korea’s crypto market, it’s change. Regulators frequently update policies to keep pace with the fast-moving industry. While this ensures a safer environment for traders, it can also create headaches for businesses trying to plan long-term. What’s compliant today might require a central pivot tomorrow.

Market Volatility

South Korean traders are famously enthusiastic, which fuels rapid price movements. The infamous “Kimchi Premium” is a testament to how local demand can drive prices far beyond global averages. For investors, this creates opportunities, but also grave risks if market sentiment suddenly turns.

Security Risks and Scandals

Despite strong regulations, South Korea has had its share of exchange hacks and fraud cases. High-profile breaches have shaken investor confidence in the past, reminding everyone that no market, no matter how advanced, is immune to bad actors. Security remains a top concern for both traders and businesses.

Taxation and Compliance Burdens

The government is tightening its grip on crypto taxation. While this legitimizes the industry, it also adds extra layers of complexity for both local traders and foreign investors. Staying compliant involves navigating reporting requirements, AML measures, and partnerships with approved banks, a process that can be both costly and time-consuming.

Barriers for Foreign Players

Global firms eager to tap into Korean demand face structural challenges. Real-name account systems, strict licensing rules, and mandatory bank partnerships can make entry into the market difficult. Without a strong local partner or a deep understanding of compliance requirements, foreign businesses risk being excluded from one of the world’s most active cryptocurrency markets.

In short, the South Korea Crypto market is exciting, but it’s not for the faint of heart. Success here requires more than just capital; it demands resilience, adaptability, and a willingness to navigate one of the most complex regulatory landscapes in the world.

Strategies for Global Investors and Businesses Entering South Korea Crypto

South Korea’s crypto market is bursting with opportunity, but diving in without a plan is like trying to play StarCraft without knowing the controls; you’ll get crushed fast. For global investors and businesses, entering the South Korea Crypto ecosystem requires more than enthusiasm. It takes cultural savvy, regulatory awareness, and the right partners on the ground. Here are the key strategies to make your entry both successful and sustainable.

Lead with Compliance

In South Korea, compliance isn’t a box to check; it’s the entry ticket. From real-name verification to anti-money-laundering standards, every business must align with the rules or risk being shut out. Before investing a single won, ensure your operations meet the standards set by the Financial Services Commission (FSC). Think of compliance not as a burden, but as a trust-building tool with Korean regulators and customers.

Partner with Local Firms

For foreign businesses, navigating South Korea’s banking partnerships and licensing requirements is nearly impossible without local allies. Strategic partnerships with established exchanges, fintech companies, or traditional banks can open doors that would otherwise remain closed. Local partners also provide cultural context, helping you avoid missteps in consumer-facing products and services.

Understand Korean Consumer Behavior

South Korean investors are unique. They’re digital-first, highly engaged, and willing to move fast when trends emerge (cue: the Kimchi Premium). Tailor your offerings to this behavior; it can be through mobile-first platforms, gamified trading features, or community-driven NFT projects. What works in the U.S. or Europe won’t necessarily resonate here.

Balance Short-Term Gains with Long-Term Strategy

The temptation to capitalize on South Korea’s retail-driven trading culture is strong, but short-term speculation isn’t the only play. Position your business or investment for the long haul by focusing on sectors with enduring growth potential, such as blockchain gaming, DeFi infrastructure, or digital asset custody solutions.

Stay Agile and Adaptive

The regulatory landscape shifts quickly. A smart strategy isn’t rigid; it’s flexible. Build room into your plans for pivoting when new rules land, whether it’s adjusting taxation policies, licensing changes, or evolving compliance demands. Agility is your survival skill in this market.

Future Outlook of the South Korean Crypto Market

The future of the South Korean crypto market is poised for both innovation and transformation, as the country continues to strengthen its position as one of the world’s most active cryptocurrency hubs. With strong adoption rates, progressive regulation, and a tech-savvy population, South Korea is expected to remain a key driver of growth and innovation in the global crypto economy.

One of the most notable future trends is the integration of cryptocurrencies into mainstream finance. The South Korean government has been gradually shaping its regulatory frameworks, with the Virtual Asset User Protection Act and guidelines from the Financial Services Commission (FSC) paving the way for a safer and more transparent ecosystem. As regulations mature, institutional investors, fintech firms, and global exchanges are likely to deepen their presence in the Korean market, boosting legitimacy and long-term stability.

Another key outlook is the rise of central bank digital currencies (CBDCs). The Bank of Korea has already launched pilot projects to test the feasibility of a digital won, which could significantly influence how citizens interact with money and digital assets. If successfully implemented, South Korea may become a model for CBDC integration in Asia.

On the innovation front, South Korea’s robust blockchain ecosystem, driven by leading conglomerates like Samsung, Kakao, and LG, will continue to push the boundaries of Web3, decentralized applications (dApps), and digital asset services. These companies are investing heavily in blockchain-based payment systems, NFT marketplaces, and metaverse platforms, reinforcing South Korea’s role as a pioneer in the digital economy.

Looking ahead, challenges such as global market volatility, evolving compliance demands, and cybersecurity threats will remain. However, South Korea’s proactive stance toward regulation and technology adoption positions it to thrive. The country is expected to see greater global partnerships, increasing institutional adoption, and the mainstream acceptance of digital assets in the coming years.

For global investors and businesses, the future outlook signals a market full of potential, where innovation meets opportunity in a secure and regulated environment.

Enter the South Korea Crypto Arena with Noji (노지)

South Korea’s crypto market isn’t just another chart to trade; it’s a battlefield where DAUs surge, floors get tested, and liquidity either flows or dies. Noji (노지) was built on wild ground, forged to help projects not just survive this arena but dominate it. We’ve scaled token holders into armies, pumped community growth into cult status, and turned early launches into liquidity machines. The next wave of Korean crypto adoption is already underway, and only those who act now will reap the benefits.

FAQs

Yes. Crypto trading in South Korea is legal, but heavily regulated. Exchanges must comply with strict KYC (Know Your Customer) and AML (Anti-Money Laundering) rules under the Financial Services Commission.

South Korea crypto regulations are enforced through the Specific Financial Information Act (SFIA). This requires exchanges to partner with local banks, register with the FSC, and follow stringent compliance measures.

Yes, foreigners with a valid Korean bank account and residency status can trade on licensed Korean exchanges like Upbit or Bithumb. However, without a local account, access is limited.

The top players include Upbit, Bithumb, Coinone, and Korbit. Upbit dominates with the majority market share, making it one of Asia’s most influential trading hubs.

South Korea’s crypto market is known for high liquidity, active retail investors, and a tech-savvy population. The country often sets global trading trends and has strong influence on token demand and price movements.