Let’s get one thing straight: Korean crypto users aren’t your average investors chasing moonshots from their mom’s basement. This is a market that treats digital assets like a national sport, where FOMO spreads faster than a K-pop hook and trading apps get more screen time than Netflix. If you think slapping on a global marketing template will cut it here, good luck. Korea’s crypto scene operates on its own rules, its own rhythms, and its own brand of chaos, a blend of genius and madness. The question isn’t that Koreans are in crypto (spoiler: they never left); it’s whether you actually understand what drives them.

Why Korea Still Matters in Crypto (Even After the Hype Cycle)

Remember when everyone thought Korea was “done” with crypto after Terra/Luna imploded? Cute take. The reality is that Korea didn’t exit the game; it just doubled down, reshaped, and kept trading like nothing happened. Unlike some markets that come and go with the bull cycles, Korea’s appetite for digital assets is baked into daily life. This isn’t a niche hobby here; it’s a cultural phenomenon.

A Market That Never Really “Left” Crypto

While Western investors ghosted during bear markets, Korean retail investors kept the lights on. Exchanges like Upbit and Bithumb didn’t just survive, they thrived. Trading volumes from Korean crypto users routinely punch above their weight compared to the size of the population. Translation: Korea is still one of the most influential retail-driven markets on the planet.

Regulation vs. Innovation: The Never-Ending Tug-of-War

Yes, the regulators are strict. Yes, the banks want everything verified and airtight. And yet, Korea still manages to churn out some of the most active communities, fast-moving projects, and unpredictable pump-and-dump cycles. Investor behavior in Korea thrives on this paradox; they crave safety nets while simultaneously sprinting toward the riskiest altcoin plays you’ve never heard of.

Why Global Brands Keep Fumbling the Korean Scene

Here’s the problem: global agencies love to lump “Asia” into one convenient bucket, forgetting that Korean crypto users don’t behave like their Japanese, Chinese, or Southeast Asian counterparts. They don’t want another generic campaign translated into Korean; they want marketing that feels like it gets them. Miss that, and your campaign isn’t just ignored, it’s roasted in Kakao chatrooms faster than you can say “HODL.”

Bottom line? When it comes to crypto trends Korea, the country doesn’t just follow the playbook; it writes its own. Ignore it at your own peril.

Who Are Korean Crypto Users, Really?

You’d think by now global marketers would have cracked the code on Korean crypto users. Spoiler: most haven’t. They still treat the Korean market like some monolithic “Asia crypto community” and then wonder why their campaigns flop. So let’s break it down: who’s actually driving the trades, trends, and memes in Korea’s crypto scene?

The Demographics: From Gen Z Risk-Takers to Cautious Late Adopters

First up, the backbone of Korea’s crypto market: young, tech-savvy retail investors who treat trading like a side hustle. Think 20- and 30-somethings glued to their phones, chasing the next pump between coffee runs. But it’s not just the YOLO crowd. Older generations, burned by stagnant real estate and traditional markets, are cautiously dipping into Bitcoin and Ethereum, hoping to hedge against inflation. The result? A bizarre mix of high-risk gamblers and conservative adopters sharing the same order books.

Cultural Context: Status, Speculation, and FOMO

Here’s the cultural kicker: investing in Korea has always been about more than just money. Status and speculation go hand in hand. Owning the right coin at the right time is social capital, bragging rights in KakaoTalk groups, and sometimes even dating material (yes, seriously). This explains why investor behavior in Korea tends to be characterized by rapid moves, emotional trading, and a herd mentality. If your friend doubled their stack on a random altcoin, you’re expected to jump in, or risk being the only one left out.

East vs. West: Different Planets, Different Playbooks

Let’s be clear, Korean crypto users do not invest like Western traders. While American investors might obsess over long-term HODLing and portfolio diversification, Koreans are far more comfortable with rapid-fire trading, chasing volatility, and rotating between coins faster than you can refresh CoinMarketCap. The difference? It’s not reckless; it’s cultural. Risk-taking is often normalized, and short-term wins are valued more highly than “safe” strategies.

In other words, if you’re trying to market to Korean investors with the same tactics you’d use in New York or London, you’re already irrelevant.

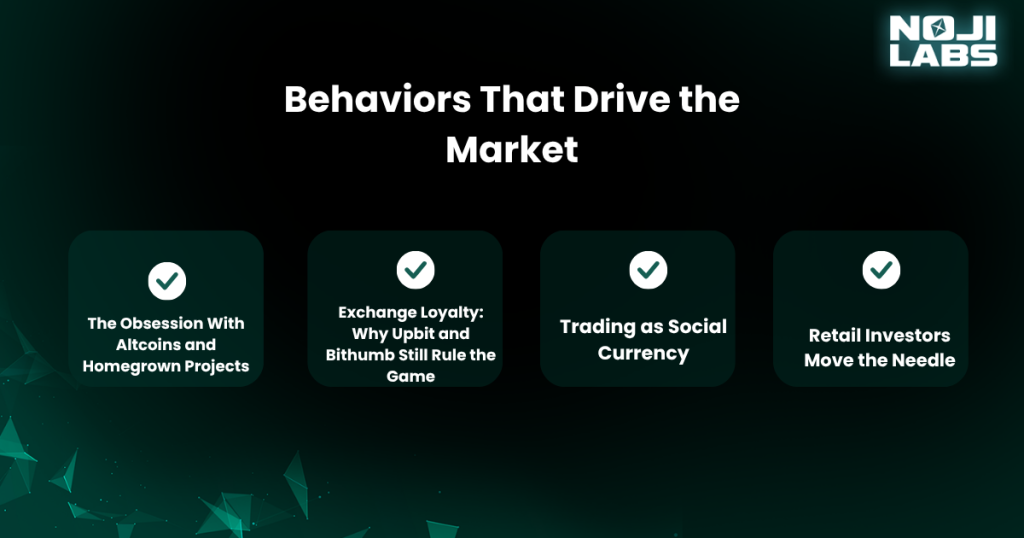

Behaviors That Drive the Market

So, we’ve covered who Korean crypto users are. Now let’s talk about what they actually do when they’re left alone with a trading app, a triple-shot iced Americano, and way too much free Wi-Fi. This is where the rubber meets the road: the daily habits, rituals, and quirks that define investor behavior in Korea and set the tone for crypto trends in Korea.

The Obsession With Altcoins and Homegrown Projects

Forget just stacking Bitcoin. Korean investors have a particular fondness for altcoins, especially those developed locally. Projects with Korean founders or those involving exchanges tend to receive an immediate boost from national pride, community hype, and the infamous “let’s all pile in” mentality. When a coin lists on Upbit, it’s practically an event. If you’re launching a project here, don’t be surprised if your random utility token suddenly becomes a “movement” overnight.

Exchange Loyalty: Why Upbit and Bithumb Still Rule the Game

Sure, Binance is a global behemoth. But in Korea? Local exchanges still win the trust game. Upbit and Bithumb are household names because they speak the language (literally) and integrate seamlessly with local banking. Investor behavior in Korea proves it: users would rather stick with familiar platforms that feel safe and compliant than chase a better deal abroad. Convenience and trust matter more than fancy global branding.

Trading as Social Currency

For Korean crypto users, trading isn’t a lonely grind; it’s a social experience. Telegram groups, KakaoTalk chatrooms, and Discord servers serve as real-time trading floors, where gossip and rumors circulate faster than any market indicator. Alpha? It’s crowdsourced. Bad calls? They’re public humiliation. Your portfolio becomes an integral part of your identity, and showcasing gains (or lamenting losses) is all part of the culture.

Retail Investors Move the Needle

Unlike markets dominated by institutional whales, Korea’s crypto scene is heavily retail-driven. Ordinary people, including students, office workers, and freelancers, have a significant influence on market direction. That’s why crypto trends in Korea often look unpredictable from the outside. One viral post, one exchange listing, or one influencer tweet can kick off massive volume swings. If you’re ignoring the retail crowd, you’re ignoring the market.

Trends That Shape the Scene

If you want to understand crypto trends in Korea, you can’t just look at charts and trading volumes. You need to zoom out and see the cultural storms, government mood swings, and meme-fueled manias that constantly reshape the landscape. Here are the trends that keep the Korean crypto scene spicy (and terrifying, depending on your blood pressure).

The Rise (and Occasional Fall) of Memecoins

You thought memecoins were just for bored Redditors? Cute. In Korea, meme tokens have evolved into full-blown cultural phenomena. It can be a dog, a cat, or a random inside joke spun into a coin; Korean crypto users can pump it into orbit if the vibe feels right. Of course, these coins also crater just as quickly, but that doesn’t stop retail investors from diving in again and again. Why? Because chasing volatility is half the fun, classic investor behavior in Korea.

NFTs, Play-to-Earn, and the Gaming Overlap

This is Korea we’re talking about, the country that essentially exports gaming as a cultural product. So, naturally, crypto trends here bleed into gaming and vice versa. NFTs, play-to-earn ecosystems, and Web3-integrated platforms aren’t just gimmicks; they’re logical extensions of an audience already trained to grind for digital assets. Want mainstream adoption? Give Koreans a game with tokens they can flex or trade, and you’ve got their attention.

The Regulation Paradox: Strict but Still Thriving

On one hand, Korean regulators love nothing more than slapping on rules, fines, and mandatory KYC requirements. On the other hand, the market refuses to die. This paradox defines Korea’s crypto narrative: tighter regulations give a sense of “safety,” while traders still run wild with high-risk bets. It’s the perfect playground for disciplined chaos, which is why global brands constantly underestimate the resilience of this market.

Institutions Tiptoe In, But Retail Sets the Tone

Yes, banks and institutional players are finally dipping their toes into digital assets, cautiously, carefully, like testing bathwater. But let’s be honest: they’re not driving the action. The heart of crypto trends in Korea still belongs to the retail crowd. Office workers trading on lunch breaks, students YOLO-ing into altcoins, and twenty-somethings checking Upbit more than Instagram, these are the real movers. Institutions may add legitimacy, but the noise, hype, and momentum? That’s all retail.

Habits You Can’t Ignore

If you really want to crack the code on Korean crypto users, forget the generic “investor personas” global agencies love to push. Koreans aren’t just investors; they’re creatures of habit, fast, emotional, and glued to their screens in ways that make Wall Street day traders look like retirees playing bingo. These everyday behaviors aren’t quirks. They’re the lifeblood of investor behavior in Korea and the reason the market moves the way it does.

High-Frequency Trading as a Lifestyle

Checking prices once a day? Amateur hour. Korean traders are glued to charts as if it were a national duty. Quick flips, scalping, and chasing green candles are all part of the grind. It’s not just about making money, it’s about staying in the game. If you’re launching a project here, understand this: if your token doesn’t have short-term volatility, most Koreans won’t touch it. Long-term holding? That’s for textbooks.

Weekend Warriors vs. Weekday Traders

There’s a rhythm to Korean trading culture. Weekdays are marked by disciplined trading during commutes, lunch breaks, and post-work downtime. But weekends? That’s when chaos reigns with more free time (and maybe a few drinks), volatility spikes. It’s no coincidence that crypto trends in Korea often heat up on Saturdays and Sundays. If your campaign drops midweek without considering weekend habits, congrats, you’ve already missed half the party.

Emotional Investing: The Thrill of the Pump

Yes, Koreans know the risks. Yes, everyone has seen the Terra/Luna crash. And yet, emotional investing is alive and well. Retail traders love the adrenaline of chasing pumps, surviving dumps, and bragging (or crying) about it in KakaoTalk chats. In other words, logic doesn’t always win here; narrative, hype, and timing often matter more. If your strategy overlooks the emotional aspect of investor behavior in Korea, you’ll never truly connect with the market.

The Language Barrier: Trust Lives in Korean

Here’s the secret sauce most global agencies miss: trust is built in Korean, not English. Community chats, whitepapers, and even memes that resonate locally matter more than polished global campaigns. If you’re not speaking the language, culturally and literally, you’re invisible. Local-language engagement isn’t just nice to have; it’s the difference between hype and crickets.

Pitfalls for Global Agencies Entering Korea

Let’s cut to the chase: most global agencies crash and burn in Korea. Why? Because they treat the market like a copy-paste job. Newsflash, Korean crypto users are not just “Asian investors with subtitles.” They’re their own beast, with unique quirks, cultural codes, and expectations that will chew up a lazy campaign and spit it out before you can say “translation fail.” If you’re eyeing Korea, here are the traps that’ll sink you fast.

Copy-Paste Campaigns That Flop

Global teams often prefer to reuse solutions that have been successful in the U.S. or Europe. Drop the same graphics, translate the captions, and call it a “local strategy.” Cute. The problem? Investor behavior in Korea differs from that in Western markets. A campaign that screams “long-term value” might resonate in New York but gets laughed out of a KakaoTalk group in Seoul. Koreans want speed, energy, and cultural relevance, not boring lectures that will hold for the next decade.

Underestimating Retail Power

Big mistake number two: assuming institutions run the show. Wrong. Crypto trends in Korea are overwhelmingly driven by retail investors. These aren’t quiet background players, they are the market movers. If your campaign doesn’t speak to office workers checking Upbit during lunch breaks or students chasing altcoins after class, you’re invisible. Global agencies continue to pitch to “decision-makers” who don’t even set the tone here.

Ignoring Language and Culture

A sloppy translation is worse than no translation at all. Koreans can spot a tone-deaf campaign in seconds, and once they roast you online, it’s tough to recover. It’s not just about language, though; it’s about cultural context. A meme that slaps on Twitter might fall flat or offend in Korea. If you don’t localize, you don’t exist.

Treating Compliance Like an Afterthought

Korea’s regulatory environment isn’t a suggestion; it’s a minefield. Yet, too many global brands launch campaigns that overlook KYC requirements, local banking regulations, or the intricacies of exchange listings. That’s not just sloppy, it’s suicidal. Local users value compliance and trust. Blow it here, and you’ll lose credibility overnight.

Bottom line? Korea is not a plug-and-play market. Treat it like one, and your “big entrance” will look more like a tragic exit.

How to Actually Reach Korean Crypto Users (Without Cringe)

Here’s the thing: Korean crypto users aren’t allergic to marketing. They’re allergic to lazy marketing. You know, the kind that looks like it was spit out of Google Translate with zero clue about the culture, the memes, or the way people actually talk in Korea. If you want to connect with them, drop the cringe, lose the cookie-cutter playbook, and meet them where they actually live (digitally and culturally).

Speak the Language, Literally and Culturally

No, running your campaign in English and adding Hangul subtitles won’t suffice. If you’re not creating content in Korean, you’re basically invisible. But don’t stop at words. Cultural tone matters; Koreans want campaigns that feel sharp, relevant, and plugged into their world. That means referencing trends, speaking the slang, and building communities in KakaoTalk, not just Discord.

Build for Retail, Not Just “Institutions”

Global agencies love courting institutions. In Korea, that’s background noise. Real traction comes from retail traders, students, young professionals, and weekend warriors. These are the people driving crypto trends in Korea, not suits sitting in boardrooms. If your campaign doesn’t have grassroots energy, it’s already dead.

Community First, Campaign Second

Here’s a radical idea: stop thinking about “ads” and start thinking about “conversations.” Community-driven factors heavily influence investor behavior in Korea. People make decisions in Kakao chatrooms, not by reading a 12-page white paper. So if you’re not building community hubs, nurturing influencers, and giving people something to talk about, your brand isn’t even in the room.

Embrace Volatility Instead of Preaching Against It

Foreign brands love telling investors to be “rational” and “long-term.” Cute, but irrelevant. Koreans thrive on volatility; it’s part of the game. If your campaign pretends risk doesn’t exist, you’ll look out of touch. Instead, show you understand the thrill, highlight opportunities, and offer tools or insights that help people play the short-term game smarter.

Don’t Overpolish It

Perfection screams “outsider.” Koreans prefer campaigns that feel alive, scrappy, and in-the-moment. Overproduced corporate messaging looks fake. Real-time memes? Viral inside jokes? A community manager who actually responds in Korean at 2 a.m.? That’s what wins.

Bottom line: if you want to reach Korean crypto users, stop trying to lecture them. Start vibing with them.

Lessons From the Terra/Luna Meltdown (Korean Edition)

Ah, yes, the great Terra/Luna implosion – Korea’s homegrown crypto soap opera that went global. Billions evaporated, Do Kwon became a household villain, and suddenly, everyone’s uncle had a “told you so” speech ready. But beyond the headlines and Netflix doc potential, the meltdown revealed a lot about Korean crypto users, their pain points, and how investor behavior in Korea reacts under fire.

Retail Got Burned Hard, But Didn’t Walk Away

The collapse wiped out savings, crushed trust, and sparked a regulatory firestorm. But here’s what outsiders missed: Korean retail investors didn’t just pack up and quit. Instead, they pivoted. They shifted toward “safer” assets, such as Bitcoin and Ethereum, but never completely abandoned crypto. That says everything about the resilience, or stubbornness, of Korean crypto users.

The Herd Mentality on Full Display

Luna was hyped like a national treasure, a local project with massive upside, and everyone was piling in. The collapse revealed just how strong herd dynamics are in Korea. When it’s hot, everyone’s in. When it crumbles, everyone panics at once. That’s not just a flaw; it’s a core feature of investor behavior in Korea. Ignore it at your peril.

Regulation Got Teeth (Finally)

If Terra/Luna did anything, it forced Korean regulators to wake up. Suddenly, compliance wasn’t optional; it was survival. Exchanges faced stricter scrutiny, and investor protections actually became part of the conversation. For marketers, that means no more “wild west” messaging. If you want credibility in Korea after Luna, you need to demonstrate that you understand (and respect) the rules.

Lessons for Marketers and Projects

- Don’t underestimate how much local pride can drive adoption, but also magnify risk.

- Build trust through transparency, as Koreans now scrutinize projects more closely than ever.

- Be prepared for volatility, both in the market and in public perception.

In short, Terra/Luna was both a cautionary tale and a roadmap. The market didn’t die; it evolved. And if you’re not adjusting your strategy for a post-Luna Korea, you’re just another clueless outsider.

Where It’s Headed, Future Crypto Trends in Korea

Korea’s crypto story isn’t slowing down; it’s evolving. While past hype cycles were driven by speculation and retail frenzies, the next chapter is shaping up to be far more sophisticated. Here’s what’s on the horizon:

1. Institutional Adoption Is Heating Up

Korean banks and securities firms are no longer sitting on the sidelines. With regulatory frameworks tightening, major financial institutions are preparing custody services, digital asset funds, and even tokenized securities. This legitimization will attract a new wave of investors who previously viewed crypto as too risky or unregulated.

2. Regulation Will Define the Game

The Financial Services Commission (FSC) and Virtual Asset User Protection Act are laying the groundwork for stricter oversight. While that might sound like a buzzkill, in reality, it’s precisely what’s needed for long-term stability. Compliance will separate serious players from fly-by-night operators, and brands that build trust through transparency will thrive.

3. Blockchain Beyond Speculation

The conversation is shifting from quick profits to real-world applications. Korea is already experimenting with CBDCs (Central Bank Digital Currencies), blockchain-based ID systems, and NFT ticketing for concerts and sports. This signals a cultural pivot where blockchain utility, not just token trading, will capture attention.

4. The Rise of Community-First Projects

Korean crypto users have always valued strong, engaged communities. Going forward, projects that prioritize transparency, cultural alignment, and localized engagement will be more effective. Expect to see more DAOs, Web3 social platforms, and gamified ecosystems tailored to Korean digital culture.

5. Global Influence With Local Flavor

Korean crypto trends don’t exist in isolation. Just as K-pop and K-drama went global, Korean crypto innovation has the potential to set standards worldwide. However, successful projects will still need to resonate deeply with local users before making the leap to a global audience.

Bottom line: The future of crypto in Korea is a mix of regulation, innovation, and cultural nuance. Brands that can navigate compliance while staying creative will be the ones leading the next wave of innovation.

Ready to Move With Korea’s Crypto Future?

The Korean crypto market is dynamic, unpredictable, and brimming with opportunity. But navigating it isn’t about chasing hype; it’s about building trust, speaking the language of the community, and staying a step ahead of regulatory and cultural shifts. This is where Noji Labs takes the wheel (because guess what, you don’t want to crash here)

We specialize in helping crypto brands cut through the noise and position themselves where it matters most: in front of engaged Korean users who are ready to believe, invest, and grow with you. Whether it’s crafting localized SEO, managing Web3 community campaigns, or building strategies that respect Korea’s unique digital culture, Noji makes sure your brand doesn’t just show up; it takes the lead.

If you’re serious about entering (or scaling) in Korea’s crypto scene, now’s the time to act.

FAQs

Because they move fast, adopt early, and amplify trends globally. Korea may not dominate in trading volume as it once did, but the cultural influence of Korean crypto users still shapes global narratives. Ignore them, and you’re basically flying blind.

Speed, FOMO, and community hype drive investor behavior Korea-style. Retail investors here don’t sit around waiting for quarterly reports; they dive in headfirst, sometimes with life savings, in pursuit of significant gains. This intensity means trends rise and fall faster than in the West.

From mobile-first trading to NFTs tied to K-culture and gaming ecosystems, Korea continues to integrate cryptocurrency into everyday life. Even after the Terra/Luna crash, Korean crypto users are exploring new DeFi models and heavily leaning into Web3 gaming.